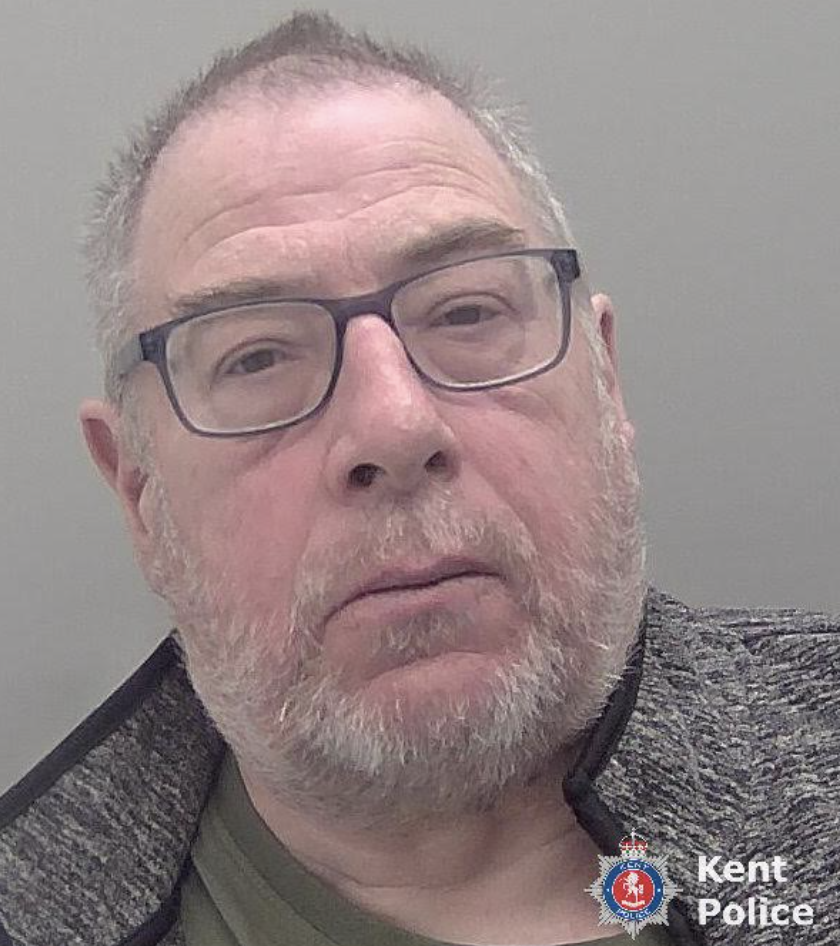

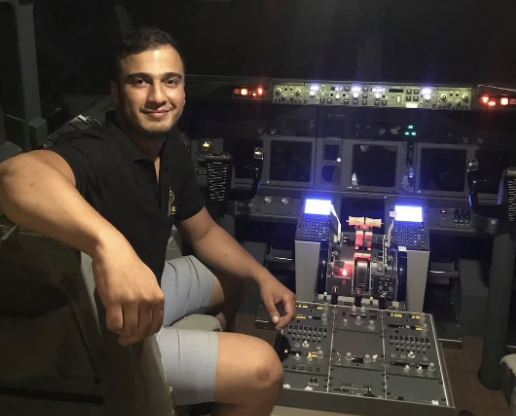

Rodney Bruce Van der Puye, 34, of Cator Street, Southwark, made around £50,000 by acting as an illegal intermediary, also known as a ‘ghost broker,’ in just over 15 months. Van der Puye targeted some of the UK’s largest insurance companies, using his, his mother’s, and the identities of unknowing members of the public to obtain cheaper motor insurance policies for his ‘customers.

The Insurance Fraud Bureau (IFB) quickly identified the ‘ghost broker’s’ illegal activity and linked 28 suspicious policies to one individual. The case was then referred to the City of London Police’s Insurance Fraud Enforcement Department (IFED) for further investigation, which led to the discovery of even more policies linked to Van der Puye.

Van der Puye was sentenced to 21 months in prison, suspended for two years, and ordered to perform 180 hours of unpaid work on July 6, 2022, at Inner London Crown Court. He previously changed his pleas from not guilty to guilty for fraud by false representation, money laundering, and providing an unlicensed regulated claims management service.

Detective Sergeant Adam Maskell, who led the IFED investigation, stated:

When the IFB referred this case to IFED, we knew we had a seasoned ‘ghost broker’ on our hands.” However, it wasn’t until we seized evidence from Van der Puye that we realised the gravity of his crime.

“The phones we seized turned out to be a goldmine of overwhelming evidence,” Van der Puye admitted. Despite this, the ‘ghost broker’ attempted to shift blame during the interview and even entered an initial not guilty plea.

“We frequently see cases where the policyholder is unaware that they are dealing with a ‘ghost broker,’ but this was clearly not the case in this case.” Van der Puye had a reputation for providing illegal services and had amassed a large number of customers, many of whom appeared to be aware of his fraudulent methods. Van der Puye has been brought to justice, but I hope his customers reflect on their actions and refrain from using a ‘ghost broker’ again.”

The initial investigation by IFED focused on the policies discovered by the IFB and implemented between 2016 and 2017. These policies were taken out in Van der Puye’s or his mother’s name, but many of them used addresses, email addresses, and bank accounts associated with other people.

Over the course of two years, 26 of these policies were purchased to insure just four vehicles. After payments were declined due to the bank account holders’ details not matching the policyholders, the insurers repeatedly cancelled the policies.

IFED officers executed a search warrant at Van der Puye’s mother’s home, where he was staying at the time. Van der Puye arrived at the property in a black BMW, one of the vehicles he had fraudulently insured.

Officers seized three phones from the property and the vehicle, with Van der Puye claiming that only one belonged to him. After Van der Puye refused to hand over the phone’s PIN, forensic investigators gained access to it. On one phone, more than 50 WhatsApp conversations and text messages about additional fraudulent policies were discovered. This evidence also revealed 113 bogus policies established by Van der Puye between May and July of this year.

The evidence from this device showed that Van der Puye’s ‘customers’ were aware of the fraudulent policies. In these conversations, Van der Puye was also addressed by name, with messages such as “Hi Rodney, I need you to do me some insurance” and “Hi Rodney, I need insurance today.”

According to Van der Puye’s responses, he charges between £80 and £150 for his services. Van der Puye provided the details of two bank accounts for these payments, one of which was in the name of his former partner.

An examination of this bank account revealed that between May 2017 and August 2018, £50,000 in transactions were made, all of which were related to insurance policies. From this total, £27,000 was transferred to Van der Puye’s account, over £6,500 to his mother’s account, and another £3,800 was paid in rent.

During an interview with IFED officers, the account holder claimed that she was unaware of the deposits because this was not her primary bank account.

According to the company that handled Van der Puye’s rent payments, these were frequently made from various bank accounts and cards and were subject to ‘chargebacks’ due to the transactions being suspected of being fraudulent.

Van der Puye was interviewed by IFED and gave a prepared statement denying the fraud. He claimed that the policies were obtained through a broker he discovered on Instagram, but when pressed, he refused to provide any further information on this individual.

The IFB’s Head of Intelligence and Investigations, Stephen Dalton, stated:

“It was clear from the start of this investigation that we were dealing with a ghost broker unlike any other.” This fraudster was not only using stolen personal information to sell bogus insurance policies on a large scale, but his customers were also in on the act, requesting fraudulent motor insurance so they could drive without being detected for driving without insurance.

“This case demonstrates how far-reaching and dangerous the consequences of insurance fraud can be.” Now that Van der Puye has been apprehended, many of his alleged clients who were knowingly breaking the law have also been prevented from committing fraud.

“After a difficult investigation in collaboration with IFED, we are very pleased to see justice served, and we hope that this conviction serves as a warning to anyone considering taking out bogus insurance services.” We’ve got them.”